Inflation Insights: Protect Your Wealth in 2025

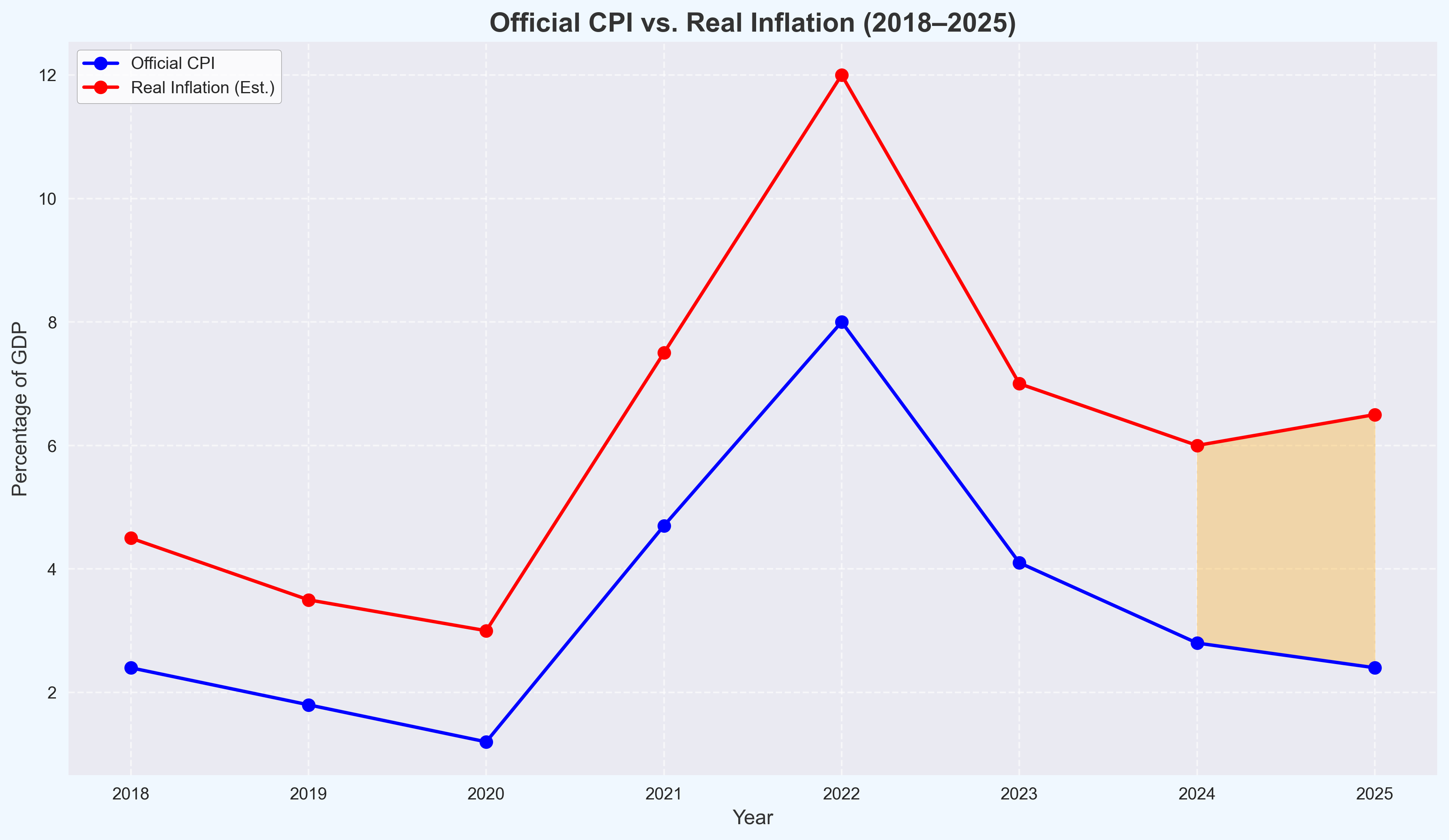

Inflation is silently eroding your wealth in 2025—official numbers like the 2.4% CPI don’t capture the real impact on your savings. Don’t let your money lose value. Fight back with proven inflation hedges: gold, silver, and cryptocurrencies like Bitcoin. Let’s explore how these assets can protect your wealth and outpace inflation.

Gold and Bitcoin step into the ring to battle inflation—your wealth’s ultimate defense.

Inflation in 2025: Why Inflation in 2025 Threatens Your Wealth

Inflation isn’t just a number—it’s a threat to your financial future. In 2025, the official Consumer Price Index (CPI) sits at 2.4% (Bureau of Labor Statistics, March 2025), but the real story is far worse. Everyday costs—think groceries, gas, and rent—are soaring faster than the CPI suggests, with some estimates pegging real inflation at 5-7%. At this rate, $100 today could be worth just $93 in a year.

Official CPI vs. Real Inflation (2018–2025): The hidden cost of living is rising.

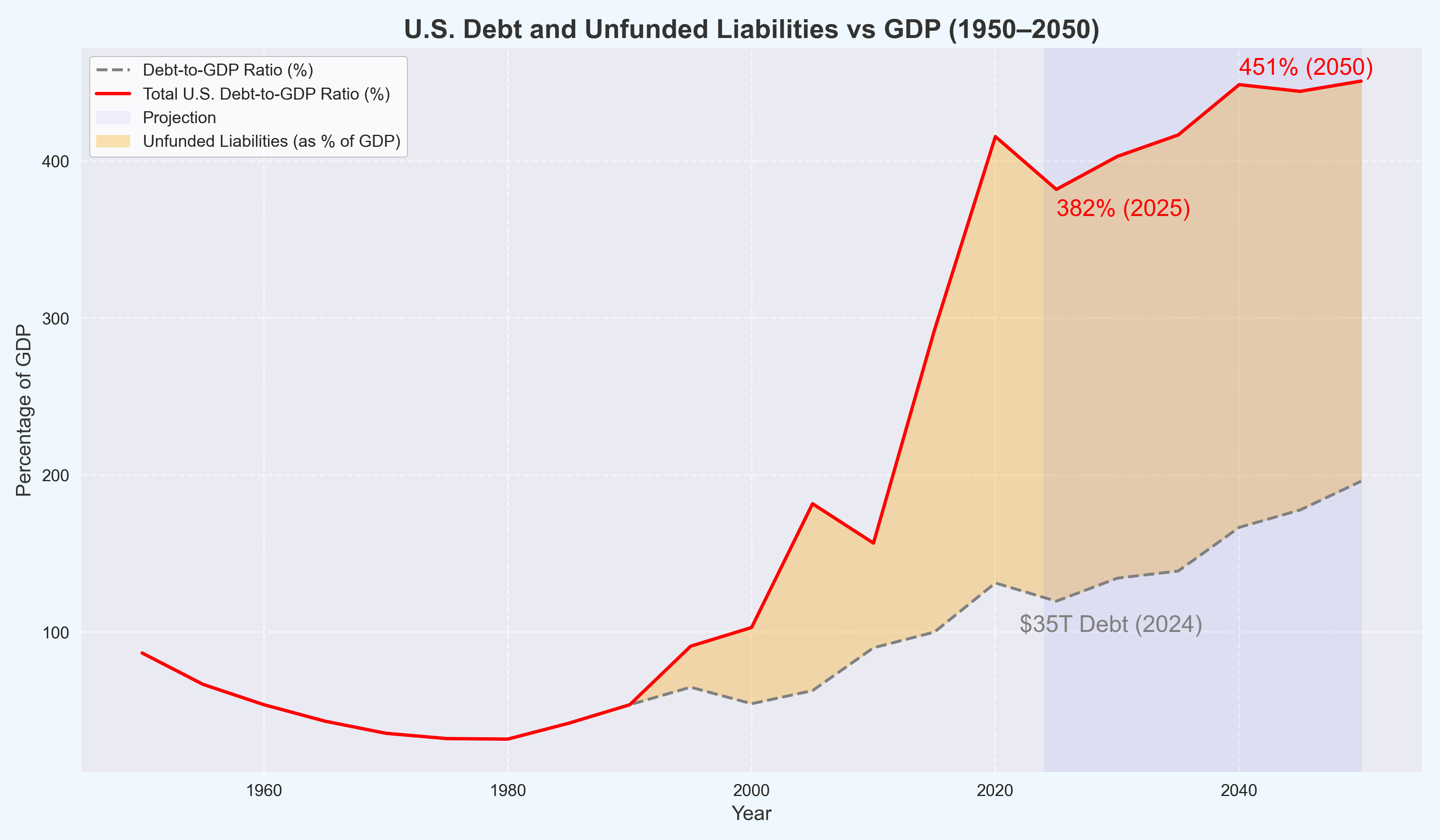

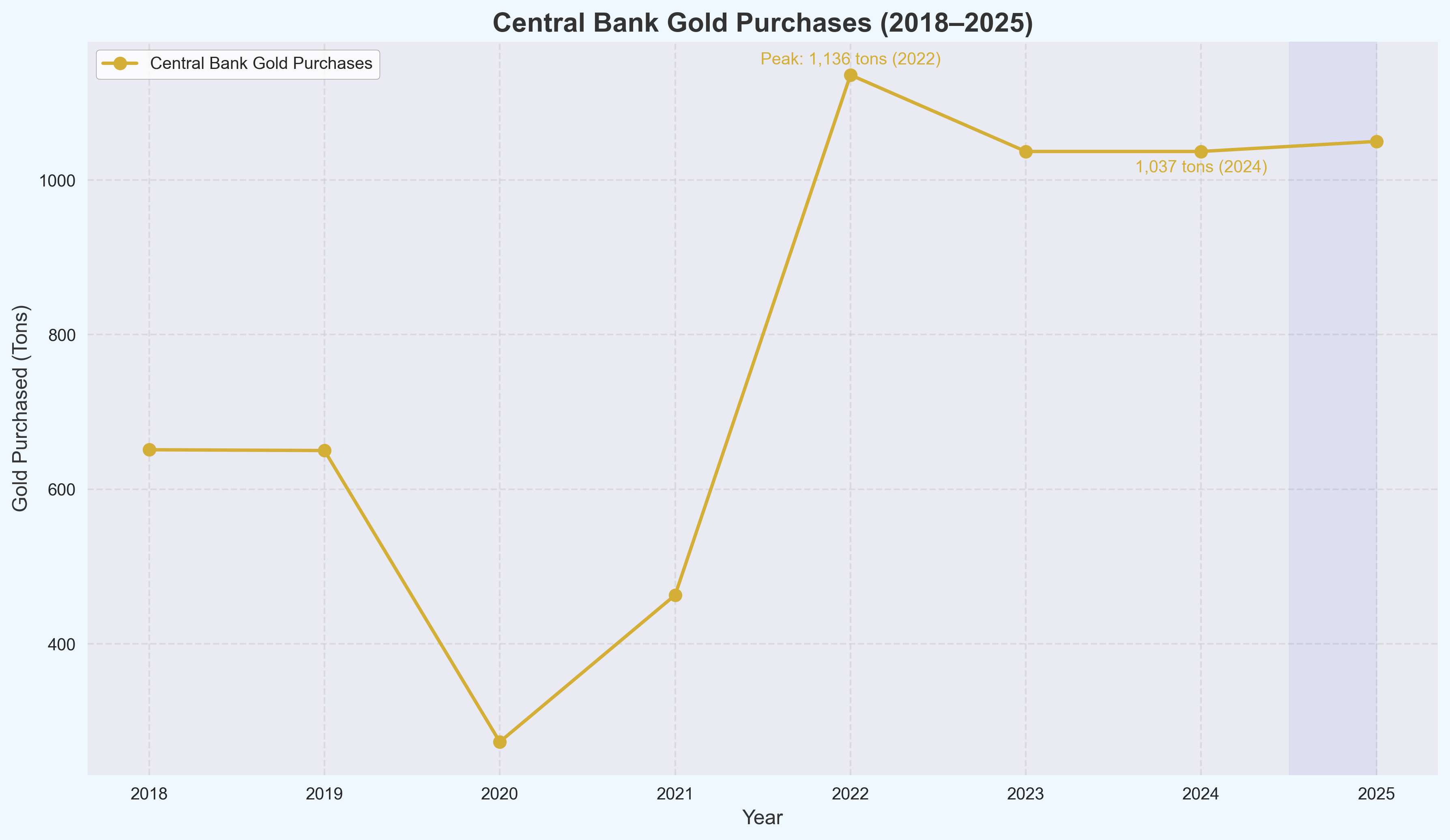

The U.S. national debt has ballooned to $35 trillion, up $4 trillion since 2023, fueling fears of currency devaluation. Meanwhile, global shifts like BRICS countries pushing for de-dollarization are shaking confidence in the dollar. Central banks are reacting—buying a record 1,037 tons of gold in 2024 to shield their reserves against a weakening dollar (World Gold Council)—while sovereign funds and countries, including the UAE (with a $436M Bitcoin ETF purchase in Q1 2025), El Salvador (holding 6,102 BTC as of March 2025), and the U.S. (exploring a Strategic Bitcoin Reserve), are increasingly acquiring Bitcoin. These pressures mean your savings are losing value faster than ever. To stay ahead, you need assets that can beat real inflation: precious metals and cryptocurrencies are your best bet.

U.S. Debt and Unfunded Liabilities vs GDP (1950–2050): Total burden reaches 382% by 2025 and 451% by 2050, threatening the dollar.

Central Bank Gold Purchases (2018–2025): A record 1,037 tons in 2024 reflects a shift away from the dollar (World Gold Council).

De-Dollarization: Big Players Turn to Gold and Bitcoin

Top Inflation Hedges: Gold, Silver, and Crypto in 2025

Gold, silver, Bitcoin, and Ethereum each offer unique ways to hedge against inflation. Here’s how they stack up.

Gold: A trusted hedge for centuries, gold holds value during inflation spikes and economic uncertainty, as seen with central banks’ 2024 gold rush.

Silver: More affordable than gold, silver offers similar hedging potential but with higher volatility, ideal for diversified portfolios.

Bitcoin: Often called ‘digital gold,’ Bitcoin’s price soared from $7,600 in 2018 to $67,500 in 2024, offering high returns with higher risk.

Ethereum: Driven by its technology and adoption, Ethereum provides a riskier but potentially rewarding hedge as blockchain grows.

S&P 500 (Benchmark): We track the S&P 500 to compare these assets against the broader market—not as an inflation hedge, but as a benchmark.

Which asset fits your strategy? Compare them with our tools to find out.

Check Live Prices to Start Comparing.What the Data Says: Performance Insights

The proof lies in the data: let’s examine how gold, silver, Bitcoin, and the S&P 500 have performed in the fight against inflation. Over the past 3 years, with an average annualized return, silver by 39.9%, Bitcoin by 27.0% and gold by 18.9% have all outperformed the S&P 500, showcasing their strength during inflationary periods. Recently, silver stands out as the top performer over the past year with an impressive 165.4% return, making it a standout choice for wealth protection. Explore the 1-year performance trends below to determine the best shield for your assets against inflation’s impact.

Performance Trends

1-Year Performance Showdown: See which assets are winning against inflation.

Take Action: Protect Your Wealth Now

Ready to fight inflation and protect your wealth? Bullion vs Bytes equips you with the tools and insights to make smart moves in 2025.

Step 1: Track Live Prices

Monitor real-time prices for gold, silver, Bitcoin, and Ethereum to seize the best opportunities.

View Live Prices Now.

Step 2: Analyze Trends

Use our interactive chart to identify the strongest inflation hedges for your portfolio.

Step 3: Stay Informed

Join our newsletter for weekly updates on inflation trends, asset performance, and expert tips to safeguard your wealth.

Get weekly insights to stay one step ahead of inflation.

Ready to Invest Wisely? Start Today!

Don’t let inflation erode your wealth—take control with Bullion vs Bytes. Begin your journey now.