Setting the Stage: Exploring the Current Financial Landscape

Introduction: Setting the Stage

Join us as we embark on a journey of exploration and discovery, shedding light on the historical significance, investment characteristics, and inflation-hedging potential of gold, Bitcoin, Ethereum, and silver. Whether you're a seasoned investor or just beginning your investment journey, our goal is to empower you with a comprehensive understanding of these assets. We want to equip you with the tools needed to navigate the ever-evolving financial landscape and make choices that align with your financial goals and aspirations.

As we delve into this series, let's start by examining the current state of the financial landscape in October 2023. This context will help us understand the challenges and opportunities facing investors in both traditional and digital assets. But first, a captivating question remains: Has Bitcoin emerged as the leader in this competition for supremacy?

The Current State of the Financial Landscape (October 2023)

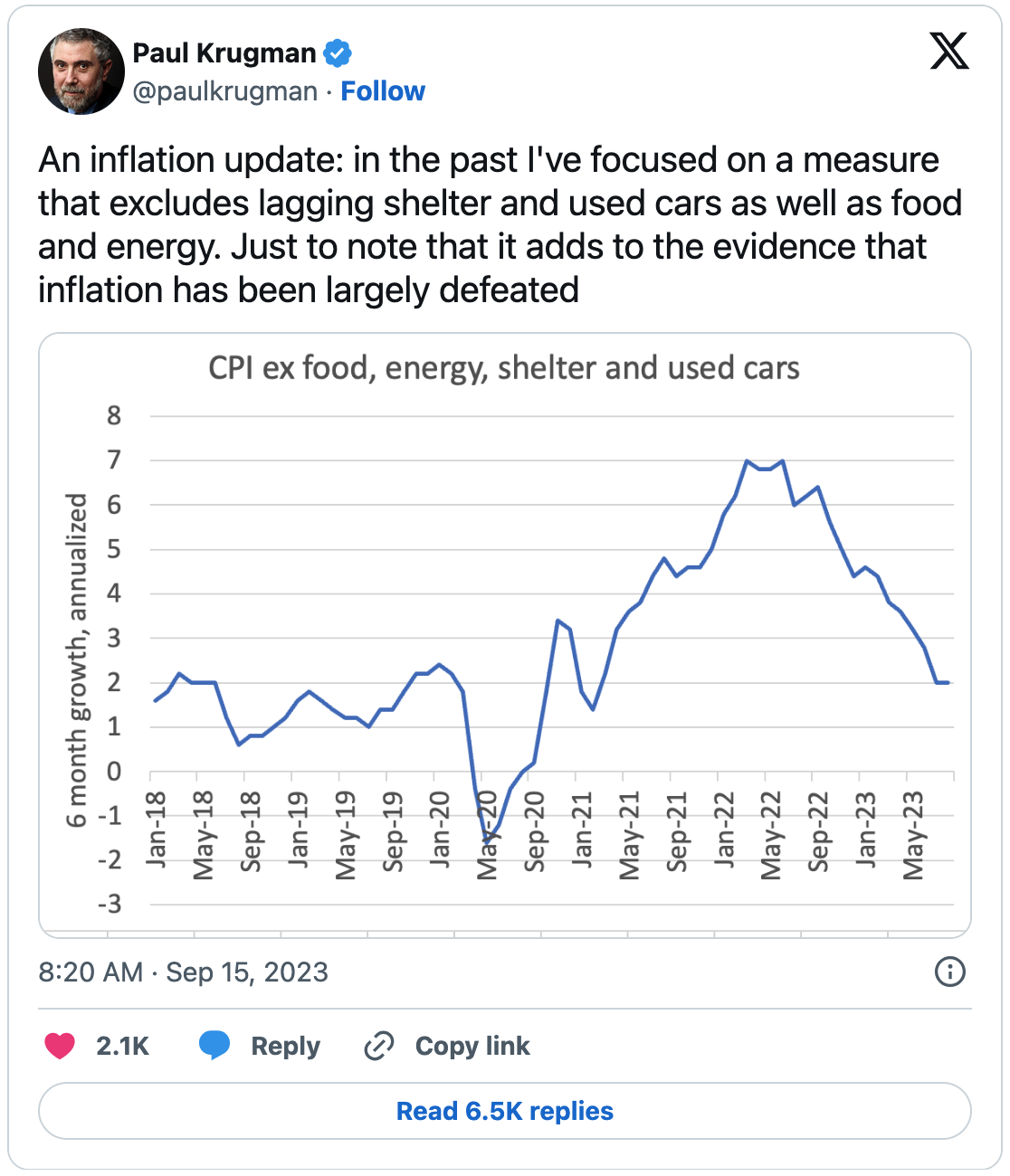

There is a lot happening in both the financial and real worlds at the moment. In the U.S, the Biden Administration has declared victory over inflation and is touting the best job market in 20 years. Nobel laureates in economics, akin to defenders of the once-reigning fax machine, chime in to assert that inflation is under control if you simply exclude food, energy, shelter, and vehicles from the equation. Yet, amid these triumphant declarations, you hear whispers of major layoffs and encounter individuals struggling to afford groceries.

Fed Chairman Jerome Powell is celebrated for orchestrating a soft landing of the economy, skillfully taming inflation. Critics, however, warn that it's only a matter of time until the next financial crisis strikes, potentially forcing the Fed to once again resort to money printing, potentially sparking inflation to new heights.

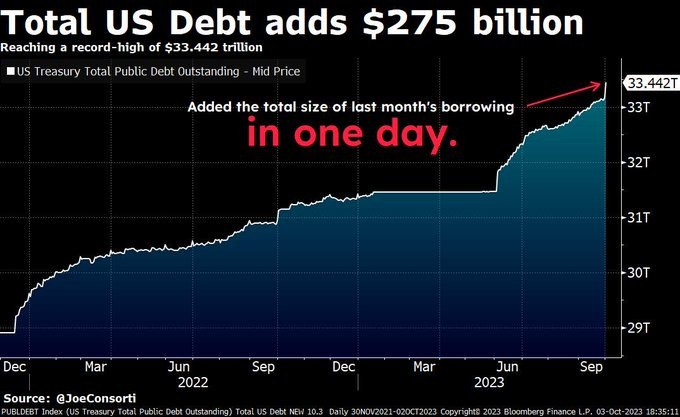

The Exploding U.S. National Debt

Amid this cacophony of conflicting narratives, one undeniable reality stands out: the U.S. national debt is skyrocketing, reaching unprecedented levels. To put this into perspective, consider that the U.S. debt increased by a staggering $275 billion in just one day, an amount equivalent to roughly 50% of Bitcoin's total market capitalization.

Soaring U.S. Treasury Yields

Simultaneously, concerns over inflation and the government's ability to manage its debt have pushed U.S. Treasury yields to new heights, with far-reaching implications for both the bond market and the broader economy.

Bond Market Turmoil

This turbulence in the bond markets is palpable, with the iShares 20+ Year Treasury Bond ETF (TLT), a proxy for long-term U.S. government bonds, experiencing a sharp decline, down more than 50% from its 2020 high.

Tech Stocks: Bulls vs. Bears

As the financial landscape experiences turbulence, technology stocks have taken center stage, introducing complexities to the diverse narratives in today's financial world.

-

Bulls are confident that recent dips represent mere corrections in an ongoing upward trend, urging investors to seize the opportunity. Their optimism is rooted in the belief that technology companies, especially those involved in exponential growth areas like AI, remain robust and promising, even in the face of high valuations.

-

In contrast, bears express caution, pointing to factors like rising interest rates and economic uncertainties. They also raise concerns about high valuations. However, it's important to remember that high valuations can be indicative of the potential for a significant market correction rather than a broad economic downturn..

These clashing perspectives reflect the broader market uncertainty. Investors grapple with the potential rewards and risks in this high-growth sector.

Precious Metals in Retreat: Recent Sell-Off and Resurgence

After a recent sell-off, the age-old safe haven of gold saw many gold enthusiasts reevaluate their positions. The sentiment was so negative that gold mining stocks were trading near their COVID-2020 lows. However, with escalating tension in the Middle East and growing global uncertainty, the story evolved.

Bitcoin's Awakening

On the other side of this turbulent landscape, Bitcoin is experiencing a resurgence. After enduring a bear market that lasted over two years, it stands as the asset class with the highest year-to-date return. Bitcoin maximalists on Fintwit are declaring victory, prompting many investors to reevaluate their positions.

Performance by asset YTD

In light of this context, one question looms large: Has Bitcoin emerged as the leader in this competition for supremacy?

Conclusion: A Glimpse into the Journey Ahead

Now, let's set our sights on the journey ahead as we delve into the precious metals vs. cryptocurrencies discussion in our 'BullionVsBytes' series. We'll explore their historical roles, investment characteristics, and performance as inflation hedges.

Here's a glimpse of what's coming:

-

The Historical Perspective: Gold

In this section, we'll dive into gold's enduring significance and its role in financial markets over centuries. But that's not all— we'll also explore its relevance in the current geopolitical landscape. With ongoing discussions about de-dollarization and shifting global economic dynamics, gold's role as a global reserve asset and a hedge against geopolitical uncertainty takes on new meaning. -

The Modern Challenger: Bitcoin

We'll introduce you to Bitcoin, the digital disruptor reshaping finance, delving into its origins and meteoric rise. -

The Rising Star: Ethereum

We'll take a closer look at Ethereum, the smart contract platform that has captured the attention of developers and investors alike. -

The Age-Old Favorite: Silver

Silver, often overshadowed by gold, will also be examined, exploring its historical significance and investment potential. -

Investment Characteristics: Strengths and Weaknesses

We'll compare the attributes of gold, Bitcoin, Ethereum, and silver, including liquidity, portability, divisibility, and security. -

Inflation Hedging: How Do They Measure Up?

Explore how these assets have historically served as hedges against inflation, uncovering their unique strengths and weaknesses. -

Risk and Volatility

We'll navigate the risk profiles and price volatility associated with each asset. -

Regulatory and Market Considerations

Discover the regulatory landscapes and market factors shaping investments in these assets. -

Diversification and Portfolio Allocation

Understand how these assets can fit into diversified portfolios, offering a balanced approach to wealth preservation and growth.

Join us on this multifaceted journey, equipping yourself with the knowledge to navigate the complexities of the financial world. Stay tuned for our next "BullionVsBytes" installment, where we explore gold's timeless significance as a store of value.