The Historical Perspective: Gold

Gold's Legacy: From Ancient Egypt to the Birth of Currency

Throughout history, gold has held a unique and enduring significance as a symbol of wealth and power. One of the most iconic historical examples of gold's value and importance can be found in the ancient Egyptian civilization.

The ancient Egyptians revered gold for its beauty and believed it to be the flesh of the gods. Gold was used to create intricate jewelry, adorn the tombs of pharaohs, and even gild the surfaces of temples and monuments. The famous death mask of Tutankhamun, a young Egyptian pharaoh who ruled over 3,300 years ago, is an exquisite example of the importance of gold in this ancient culture. This mask, made of solid gold, was placed over the face of the deceased king in his tomb, highlighting not only the aesthetic allure of gold but also its association with the afterlife and immortality.

Mask of Tutankhamun

Furthermore, the use of gold as a form of currency and a store of value dates back to ancient civilizations such as the Lydians, who were the first to mint standardized gold coins in the 7th century BC. These coins provided a universally accepted medium of exchange and a reliable store of value, marking a crucial step in the development of money and trade.

The Gold Standard Era: 1971 Nixon Ends an Era

In the 19th and early 20th centuries, the gold standard played a pivotal role in shaping the international financial system. Under this system, the value of a country's currency was directly tied to a specific quantity of gold. For example, in the United States, the Gold Standard Act of 1900 established that one ounce of gold was equivalent to $20.67. This fixed exchange rate between the currency and gold served as a mechanism to maintain the stability and integrity of a nation's money supply.

The gold standard brought relative price stability, prevented governments from engaging in excessive currency printing, and facilitated international trade. However, it could also be restrictive, tying a nation's money supply to its gold reserves. These constraints sometimes exacerbated economic downturns during periods of financial crises. The gold standard began to weaken and eventually collapse in the early 20th century, especially after the First World War. The costs of maintaining the fixed exchange rate and the impact of the war led to its gradual abandonment. The Great Depression in the 1930s further strained the system, and the United States officially abandoned the gold standard in 1971 under President Richard Nixon.

The Bretton Woods System and the U.S. Dollar's Ascent as the World's Reserve Currency: 1944-1971

Following the collapse of the gold standard in the early 20th century, the world needed a new international monetary system to stabilize global finance and promote economic cooperation. This led to the establishment of the Bretton Woods system in 1944, named after the town in New Hampshire where the agreements were reached.

Under the Bretton Woods system, the U.S. dollar was designated as the world's primary reserve currency, and other major currencies were pegged to the dollar. The dollar itself was pegged to gold at the rate of $35 per ounce, creating a quasi-gold standard.

The system was designed to foster economic stability, encourage international trade, and provide a foundation for post-war reconstruction and economic growth. However, it faced challenges in the 1960s, as U.S. trade deficits and a growing supply of dollars raised doubts about the sustainability of the fixed exchange rates. Eventually, in 1971, President Richard Nixon announced the suspension of the dollar's convertibility into gold, effectively ending the Bretton Woods system. This marked a significant turning point in the history of global finance and highlighted the importance of the U.S. dollar as a reserve currency, setting the stage for the modern financial landscape where the dollar remains a dominant global currency.

Nixon closes gold window August 15th, 1971

The Current Role and Geopolitical Significance of Gold

Gold's contemporary relevance in the geopolitical landscape is significant. While it is no longer directly linked to international currencies, it plays a crucial role in global finance and politics. Here are some key aspects to consider:

De-dollarization and the China-Russia Yuan Oil Agreement

De-dollarization has emerged as a prominent trend as nations endeavor to reduce their dependence on the U.S. dollar in global trade and finance. This trend has gained momentum, particularly in light of concerns about the stability of the dollar, ongoing trade disputes, and the frequent use of sanctions as a tool of foreign policy.

One noteworthy example of de-dollarization is the China-Russia Yuan oil agreement, which is a direct response to the imposition of sanctions by the United States and other Western powers. In this agreement, China and Russia have established a bilateral trade arrangement where they conduct energy transactions in Chinese Yuan (CNY) rather than the U.S. dollar (USD). This significant move challenges the U.S. dollar's historical dominance in global energy trade.

The decision to use the Yuan as the trading currency is a strategic response to the use of the U.S. dollar in punitive economic measures, such as sanctions. By using the Yuan, China and Russia aim to shield themselves from the impact of these sanctions and reduce their reliance on the dollar-dominated financial system. Additionally, the Yuan's flexibility allows for the settlement of international trade and the storage of surpluses in gold through the Shanghai Gold Exchange (SGEI), further enhancing the strategic importance of this currency shift in the global economic landscape.

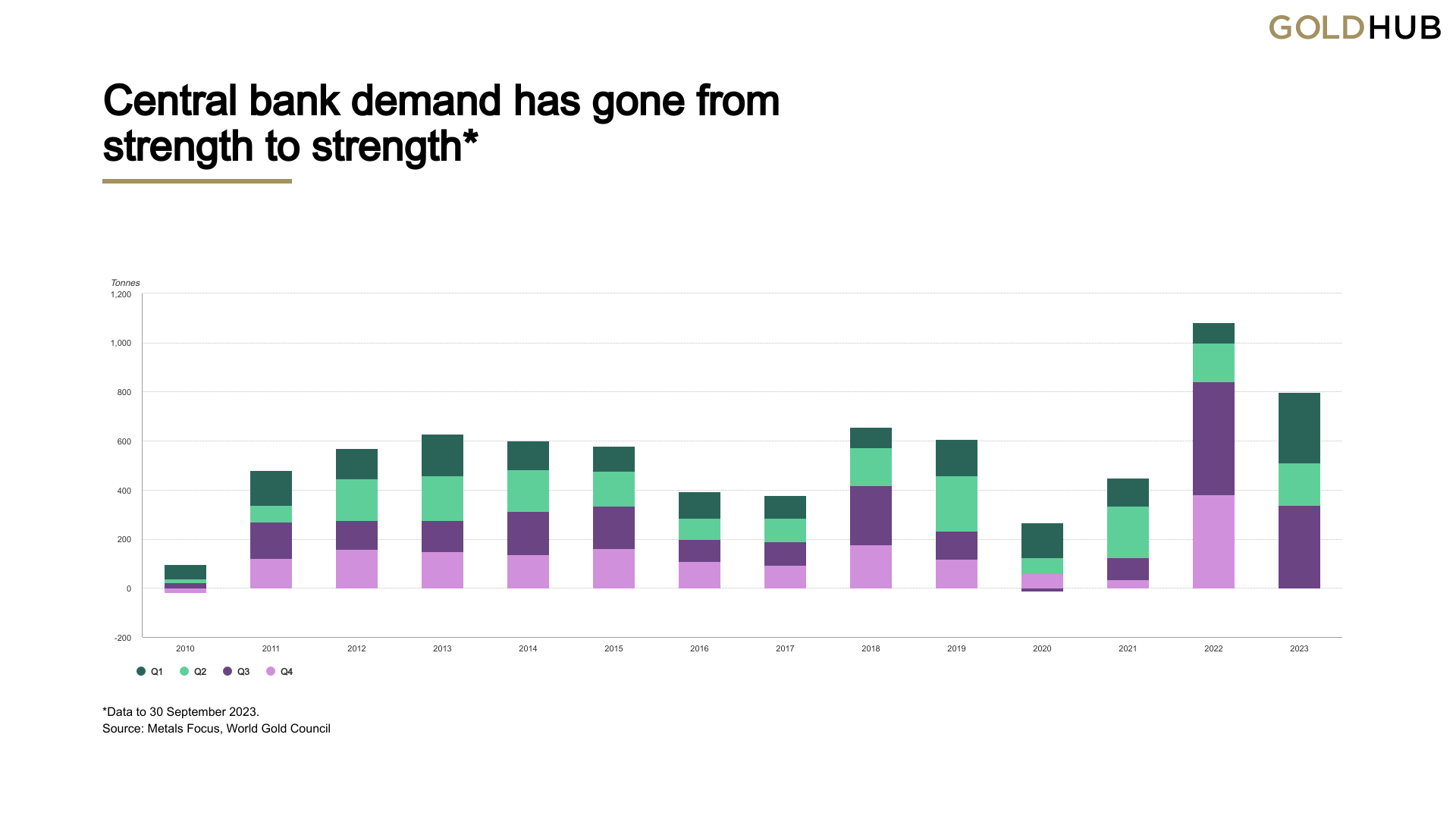

Central Bank Policy

Central banks, including those in emerging markets like China, Poland, Singapore and India, are actively buying gold to diversify away from the U.S. dollar. Gold's versatility, as it can be swapped into any currency, makes it an attractive option for these institutions as they navigate the evolving global financial landscape. This reflects concerns about the stability of the global financial system.

Global Central bank gold purchase 2010 - 2023

China's Actions Regarding US Treasuries and Gold:

Since 2014, China has been net selling U.S. Treasuries, signaling a shift in its approach to U.S. debt holdings. This move reflects evolving dynamics in China's international financial strategy and its focus on diversification. Simultaneously, China has actively increased its gold holdings, highlighting its broader strategy to enhance financial security and diversify its reserve holdings beyond traditional U.S. dollar-denominated assets.

Conclusion

In summary, the contemporary geopolitical landscape reflects a significant shift away from the U.S. dollar as a secure reserve asset. Instances of de-dollarization, exemplified by initiatives like the China-Russia Yuan oil agreement, signify a global effort to reduce reliance on the dollar amid concerns about its stability, trade disputes, and sanctions. Central banks, particularly in emerging markets, are actively turning to gold for diversification, recognizing its stability and versatility. China's move away from U.S. Treasuries towards gold underlines a broader sentiment that the U.S. dollar may no longer be considered an unequivocally safe asset, given apprehensions about the U.S. debt and fiscal situation. In this evolving financial landscape, gold emerges as a pivotal asset, offering stability and diversification beyond traditional dollar-denominated holdings, marking a significant reevaluation of the global economic order.